Online Casinos in South Africa

The list presented below will be presenting the top online casino on this site. Proper research is being carried out before our team could recommend them as the best online casino in South Africa. The payment methods on these platforms are swift and efficient such that the South African players will be able to make a deposit, and also withdraw their winnings using the banking option that is convenient for them. Register today, and claim real bonuses on these fantastic sites. These casinos include

FAQ

The fact is that there will be some players that did not have a full understanding of what online casino entails; for this reason; there will be some questions that they will need verification on. The section created for the frequently asked questions is specially made to address the common issue and problems, and the provision of the knowledge required such that players who seek the online casino south africa no deposit will have a rewarding and safe experience while gambling on an online casino

The reason why you need to play online casino in South Africa

The players in South Africa have so many options when it comes to where they can carry out their gameplay, unlike some other places around the world where players have limited options. On our site, the sole aim is to ensure the supply of the necessary details to the players in South Africa such that they will know the kind of casino that they can play for real money or for free. On the casino listed above, you can deposit with the Rand, and then you will get paid and get to claim your bonuses. These online casinos offer a free toll anytime you wish to speak to a support rep regarding any issue. To a considerable extent, these casinos are transparent, trustworthy and regulated. The casino can be played by players in different provinces in South Africa. They include North West, Gauteng, KwaZulu-Natal, Mpumalanga, and the Cape Town, be it North, East or South

Is it safe to play an online casino

One thing that players should be careful about when choosing an online casino is the security, and they must ensure the fact that the site is well regulated and licensed by the appropriate online casino. A secure casino will provide the fact that players get the necessary protection needed. The licensing is an indication that the operation of the site is by the laws that surround gambling. The online casino that we recommend are those that make use of the advanced technology for the proper encryption, such that all the financial and personal information of the players are safely kept

Games Offered

These online casinos will ensure the fact that players get exceptional and quality games that will surpass their expectation. The games that players will get to see can be said to be the same thing with the land-based casino. The games on this casino are well tested for fairness; for this reason, all players have equal chances of making wins o this casino. The casinos recommended by our site will make you have a huge selection of table games and slots, and players will derive a great benefit from the speciality games and the video poker

Is it possible to win real money?

The moment players complete their registration on an online casino, they will be asked to choose the kind of payment method they prefer, they will be asked if they prefer to play the games for a cash wager. So far players have made a deposit, and bet on the casino with their cash, all winnings generated can be kept and withdrawn. For this reason, winning cash online is yes.

Are the Casinos Legal?

For players from South Africa, some casino sites are specifically designed to cater to their needs. These sites are legal, and their operation is strictly by the provision of the law. So is only left to the players to disclose some of your winnings for tax purposes

Are there Casino Bonuses?

These casinos offer players the chance to win free cash. Of course, these bonuses can be sued on the top games that support them. The thing is that not all casino will really support these games, but then most of them make provision for a generous welcome bonus to give players a warm welcome

How safe are the games?

Real-Time Gaming and Playtech always power these casinos. Of course, these two can be said to be part of the top-notch leading provider in the industry. Games that are provided by these two are of great quality, they are reliable and safe, and you are going to get the best of experience

The Projection of the Rise of Gambling Revenue in South Africa to rising to R30 Billion in 2019

Since 2014, the gambling revenue has improved to some reasonable extent, despite the weakening economies and the challenges. The gross gambling revenue in South Africa has posted their second-largest annual increase in the last five years as casino takes the most significant share as casino rises to 4.5% in the year before. Generally, as of 2014, the revenue generated by the gambling revenue in South Africa is R2.1 billion. The gross gambling revenue across those sectors is expected to rise R23.9 billion straight to R30.3 billion. The annual increase is 4.8%

We got some highlights from the fourth annual edition of the PWC, and the title is “Taking the odds: Gambling outlook for 2015 – 2019. The publication is on a detailed analysis of the gambling industry. Each of the segments as the key trend which is observed, the challenges, and the prospect. The national gambling board in South Africa can be said to be the source of this data. Looking at the way it pertains to Nigeria, figures are extrapolated and derived from companies based on selection. While talking about the Kenya figures, they are extrapolated and derived by the casino taxes

Out of the three countries that the research was carried out on, the country that happens to have the largest gambling market in South Africa. The gambling revenue is approximated to be R17.2 as of 2014, while in Nigeria and Kenya, they are R479 million and R2118 million respectively

The gambling industry in South Africa made it clear that the gambling industry in South Africa will remain exciting and vibrant just like it has always been, but then it is essential to state the fact that the sector is facing some challenges as there are changes in the regulation of the economic climate

One of the issues that are having a debilitating effect on the sector is illegal gambling online. Aside from this, some casino is as well facing some competition from other facilities that can be found in their areas

The South African Gambling Market

In South Africa, part of the most significant gambling component is the casino market, as the total revenue amounts to 72% of the gambling revenue in 2014. This is a reflection of the maturation of the segment. As things stand, 38 out of the 40 are now running smoothly. The department of trade gave an intention to increase the number of licenses on the #1st October 2015

Other forms of gambling are posing high competition, and they include limited payout machines, electronic bingo terminal, and some other sport betting

Gambling taxes and levies

As of 2014, the total amount of levies and taxes is R2.5 billion. The amount that was estimated on the VAT Output is R1.9 billion, and you can probably consider it to be 11% of the gambling revenue

Casino Gambling

The leading province was Gauteng, and the revenue is generated as of 2014 is R7.2 billion. The western cape and the KwaZulu-Natal, each of them has like 5 casinos that carry out a better operation. These provinces are so significant, and the amount they hold in the gambling revenue is 76.1%

As of 2015, the projection that was made was for the gambling revenue to drop to 0.4%, and this is making the absolute reflection of the slow economy. After then we try to figure out the better improvement, the economic condition was able to maintain its stability, and this gives some individual operators such as Tsogo Sun and the Sun International to make an expansion of some properties. At this same moment, the casino industry will as well be faced with significant competition as the Bingo Outlet and the LPM expand.

Limited Payout

The limited payout machine is primarily located in the clubs, restaurants, and bars, and they accounted for 9% out of the gross revenue in 2014. The projection was made that in 2019, it will expand by 10.3%. Of course, the introduction of new sites and machines is responsible for the expansion of the market. Having said this, the competition that arises from the terminal of the electronic Bingo will lead to the slower growth for the LPM

Bingo

This happens to be the smallest category as it accounts for 5% in the gross revenue. In 2014, the availability of Bingo was made in KwaZulu-Natal, and it derived much benefit from the North West and Eastern Cape for a full year. Guateng dominates the market continuously as it generated R903 million, the Eastern Cape followed it by R114 million. The introduction of the electronics terminal are yet to be introduced into Free State, Limpopo, Northern Cape and the Western Cape. Expectation is placed on Bingo to turn out to be the category that grows at a very fast pace. Projection was made for 19% compound annual increase, then in 2014 it is R1.1 billion and it will later rise to R2.7 billion in 2019

Sports Betting

The dominant market in sports betting market as 2014 is the horse racing, it is at R1.9 billion. As at 2015 there were speculations that the lack of wagering that is related to the world cup can have a debilitating effect on the sports betting market

National Lottery

Through the forecast period, the National Lottery is expected to remain the category that experiences the slowest growth. The National Lottery projects that the Gross Gambling Revenue will rise from R2.28 billion then in 2014, and in 2019, it will have risen to R2.33 billion

Casino Gambling in Nigeria

In 2014, the gambling revenue rose by 17.1%, as they continue the annual increase of double-digit. The Ebola virus that hit the country in 2014 does not affect the casino. The only thing that affected it was the slowing growth rate of the economy, and this is as well responsible for the slow growth in the industry. The forecast that was made then was that there would be 8.5% compound annual rate in USD68.9 million in 2019

Of course, Nigeria is expected to witness an expansion compare to South Africa and Kenya

Casino Gambling in Kenya

The casino gambling revenue in Kenya rose by 6.9% in Kenya as of 2014; in 2013, there is an 11.2% increase. Between 2009 and 2011, the annual growth is 24.2%. The conclusion was that the 20% withholding tax that was imposed id responsible for the slow down that occurs. Additionally, the competition that arises from the national lottery can as well contribute to this

Just like Nigeria, Kenya has been disturbed by terrorism, and this has hampered tourism. Having said this, the casinos in the industry do not have to rely on tourism before they run successfully. The forecast that was made is that there is an increase of 7.5% in the compound annual rate and it rises from 20.1 million USD as of 2014, to 28.9 million USD in 2019

Conclusion

Calicchio concluded that the overall gambling industry in Nigeria and South Africa is changing from time to time. Having said this, the industry will be affected adversely as it experiences a slower economic growth. But then if you can improve the economic condition, spending will be fueled at a very fast rate. While in Kenya, the growth remains stable during the next five years in comparison 2014 increment

To sum it up in the three market regions, the revenue is totaled to be R19.9 billion, which is estimated to be 1..8 billion USD as of 2019. The annual increase is 2%

The Best South Africa Online Casino Bonuses for 2023

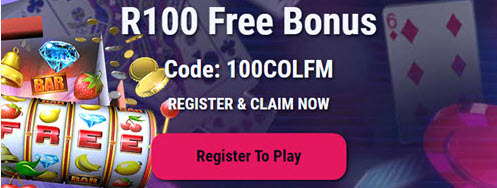

| # | Casino | Rating | Bonus | Bonus Code | |

|---|---|---|---|---|---|

| 1 |  |

Read Review | R100 Free! | 100COLFM | Visit |

| 2 |  |

Read Review | 50 Free Spins! | ON-LINEFS | Visit |

| 3 |  |

Read Review | R300 Free! | TAKE300 | Visit |

| 4 |  |

Read Review | R300 Free! | TAKE300 | Visit |

| 5 |  |

Read Review | 20 Free Spins | gift | Visit |